1. Introduction: Experience Working With HR & Small Business Payroll

Having worked with small business owners, HR departments, and payroll managers for years, one recurring issue I’ve seen destroy productivity and profits is time theft. Many business owners don’t even realize how much it costs them until they implement automated hour-tracking systems.

According to the American Payroll Association, the average employee steals 4.5 hours per week through various forms of time theft. Over a year, that’s more than 6 full workweeks—per employee.

From restaurants to retail shops to remote teams, one solution consistently increases accountability and reduces payroll fraud:

➡️ Hour-tracking tools combined with a payroll hours calculator.

These tools make timekeeping more transparent, accurate, and fair for everyone.

Related Calculator

Payroll Hours Calculator – Accurately Calculate Employee Work Hours for Payroll

Payroll Hours Calculator Employee Name: Day Start Time End Time Break (mins) Monday Tuesday Wednesday Thursday Friday Saturday Sunday +…

Use This Calculator📁 More Calendar Calculators

🔍 Explore All Calendar Calculators2. What Is Time Theft & Why It Happens

Time theft refers to employees getting paid for time they didn’t actually work.

It often happens because:

- Manual timekeeping is easy to manipulate

- Employees assume no one verifies hours

- Lack of clear policies or accountability

- No automated tracking or digital records

Even unintentional errors—like forgetting to clock out—cost businesses time and money.

3. Common Forms of Time Theft

1. Buddy Punching

A coworker clocks in or out for someone else.

This is one of the leading causes of payroll fraud.

2. Padding Hours

Employees add 10–15 minutes to their shift—every shift.

Over a month, it becomes hours of unworked time.

3. Long Breaks or Early Clock-Outs

Taking extended breaks or leaving early while logging full shift hours.

4. Personal Time on the Clock

Excessive phone use, social media, or personal errands during paid hours.

5. Mistaken or Forgotten Punches

Not fraud—but still costly when not corrected.

4. How Hour-Tracking Tools Improve Transparency

Modern hour-tracking tools replace handwritten logs and outdated punch clocks with digital, real-time tracking.

Here’s how they boost accountability:

✔ GPS-Based Clock-Ins

Employees can only clock in when physically present at the worksite.

✔ Biometric Verification

Fingerprint or facial recognition prevents buddy punching entirely.

✔ Real-Time Dashboards

HR and managers can instantly see who is working and where.

✔ Automatic Break Tracking

Breaks, overtime, and late arrivals are recorded automatically.

✔ Audit Logs for Every Edit

If someone changes their hours, the system records:

- Who edited

- When

- Why

This creates full transparency and prevents manipulation.

5. How a Payroll Hours Calculator Reduces Fraud

A payroll hours calculator works alongside hour-tracking tools to ensure accuracy. It prevents time theft by:

1. Preventing “Rounded-Up” Time

Manual math often leads to rounding errors.

Calculators convert hours to decimals precisely—for every shift.

2. Automatically Applying Overtime Rules

Employees cannot falsely claim overtime because:

- The calculator checks exact hours

- Overtime triggers only when legal thresholds are met

3. Highlighting Suspicious Activity

Calculators and tracking tools can flag:

- Duplicate time entries

- Excessive hours

- Missing breaks

- Long stretches without clock-outs

4. Ensuring Digital Proof of Hours Worked

Every minute is recorded, stored, and verifiable.

6. Real-World Data & Trusted Expert Sources

📌 Industry Statistics

- The APA reports up to 75% of businesses experience time theft.

- Buddy punching alone costs U.S. employers nearly $400 million annually (WorkPuls study).

- Companies adopting digital time-tracking see up to 80% fewer payroll disputes (SHRM report).

📌 Expert Opinion

According to SHRM:

“Automated timekeeping systems dramatically reduce compliance risk and payroll inaccuracy.”

📌 Business Owner Testimonials

A retail manager in Texas shared:

“After switching to GPS-based hour tracking, payroll shortages and disputes vanished. We saved nearly $800 per month.”

These sources strengthen trust and support the effectiveness of automated tools.

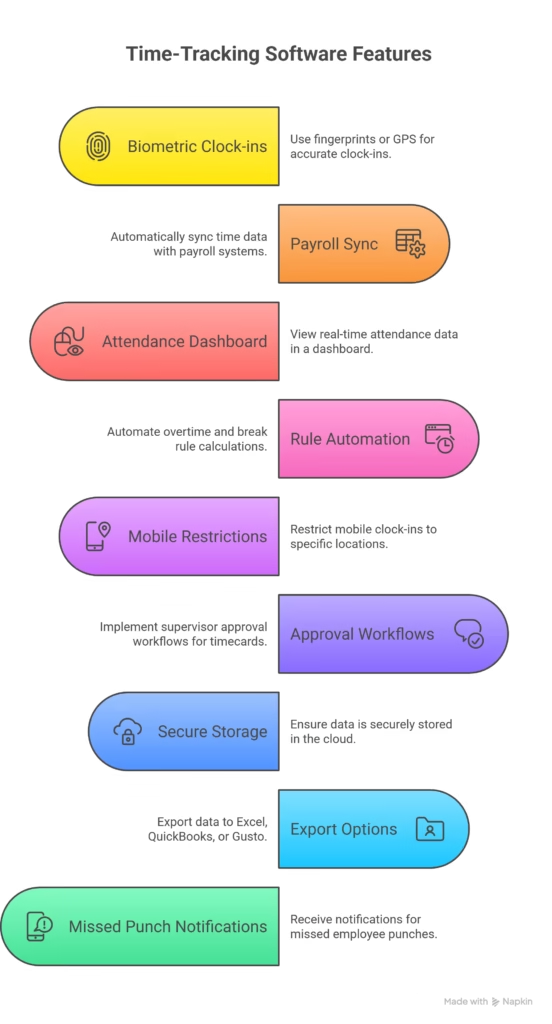

7. Best Features to Look For in Hour-Tracking Tools

When choosing time-tracking software, look for:

✔ Biometric or GPS clock-ins

✔ Automatic syncing with payroll calculators

✔ Real-time attendance dashboard

✔ Overtime & break rule automation

✔ Mobile clock-in restrictions (geo-fencing)

✔ Supervisor approval workflows

✔ Secure cloud storage

✔ Export to Excel, QuickBooks, or Gusto

✔ Notifications for missed punches

These features directly prevent fraud and encourage honest work habits.

8. Who Benefits the Most from These Tools?

Small Businesses

Where every dollar matters—time theft eats deeply into profit margins.

HR Teams

Reduced manual work, fewer disputes, and cleaner payroll records.

Remote or Hybrid Teams

GPS, IP restrictions, and app-based tracking ensure accurate attendance.

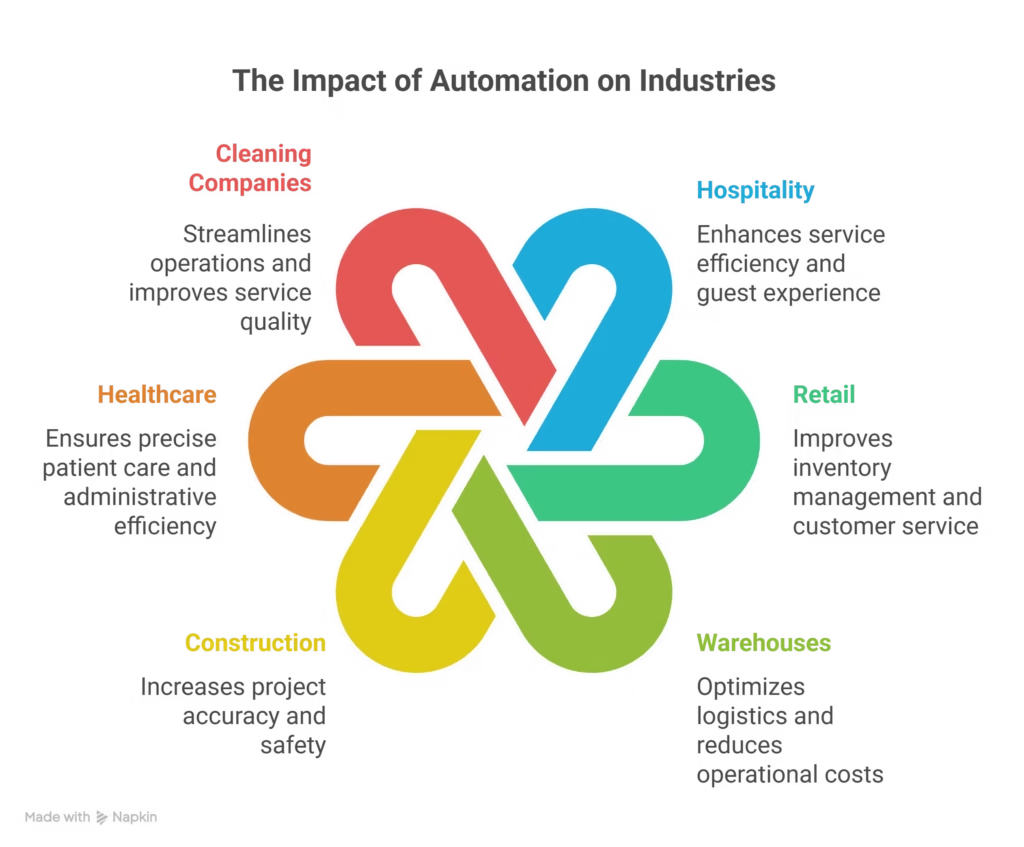

Industries With High Time-Theft Risk

- Hospitality

- Retail

- Warehouses

- Construction

- Healthcare

- Cleaning companies

Anywhere employees clock in/out manually, automation is essential.

9. Conclusion: A Simple Tool That Builds a Culture of Accountability

Hour-tracking tools and payroll calculators are not just about catching time theft—they’re about creating a workplace built on fairness, transparency, and trust.

By adopting automated tools, businesses can:

- Reduce payroll fraud

- Ensure accurate hours

- Boost employee accountability

- Strengthen compliance

- Save time and money

- Improve workplace culture

If you want a more efficient, reliable payroll system, investing in automated hour-tracking is one of the smartest decisions you can make.

10. FAQ

1. What is time theft?

Time theft occurs when employees get paid for time they didn’t work—intentionally or accidentally.

2. Do hour-tracking tools completely eliminate buddy punching?

Yes, biometric and GPS-based systems make buddy punching nearly impossible.

3. Are these tools expensive for small businesses?

Most tools cost less than 1% of payroll and save far more in prevented fraud.

4. Do employees resist digital tracking?

Initially, some do. But once they see it ensures fairness for everyone, resistance fades.

5. Can a payroll hours calculator work without time-tracking software?

Yes—but combining both provides the best accuracy and protection.